How To Generate an IFTA Report With TruckLogics for the Third Quarter [Update]

reading time: 7 minute(s)

The IFTA deadline for the third quarter of 2022 is Monday, October 31st.

Are you tired of having to manually do the calculations for IFTA? Look no further than TruckLogics and its IFTA-only option. Here you can generate IFTA reports by entering your data via manual upload, a TruckLogics Excel template, or through Motive ELD. TruckLogics will do the calculations for you and keep track of all of the IFTA tax rates so you don’t have to.

Below you will find how to generate your report with TruckLogics in only a few simple steps!

Creating an IFTA Report using IFTA-Only

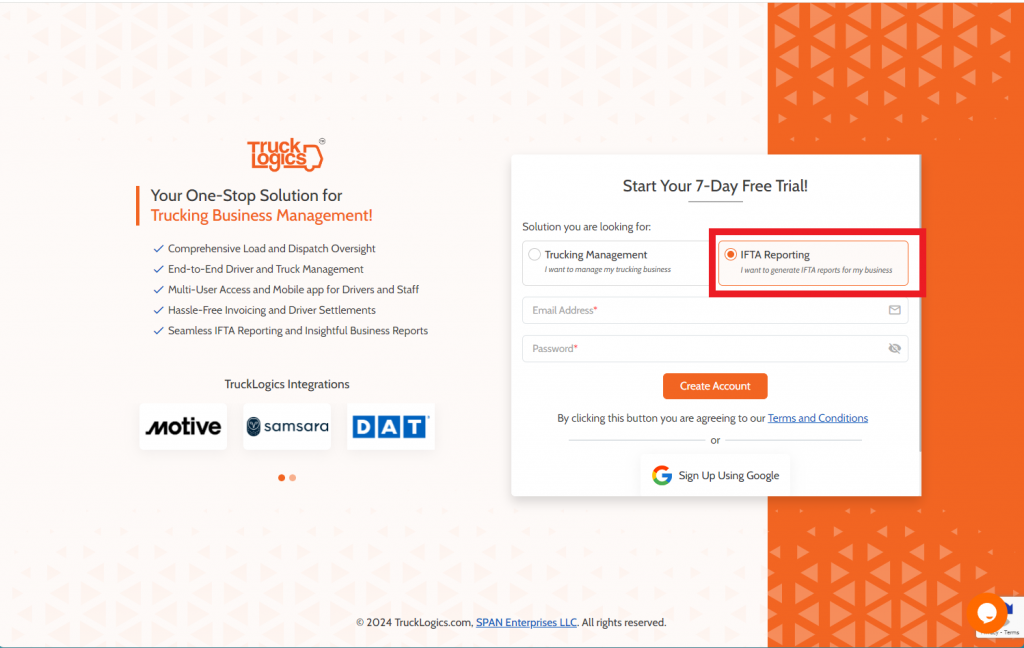

1. First, when using the TruckLogics IFTA-only option you will need to create an account. Select whether you are a Business Owner or a Service Provider and enter your business name, and contact information.

You will then select the plan you want. There are two options, the

- The “IFTA Reporting” option

- The “Trucking Management” option, which is a subscription-based service that will give you access to all of the features needed to manage your trucking business.

For the purpose of this tutorial, we will choose the “Generate IFTA Report Only” Option.

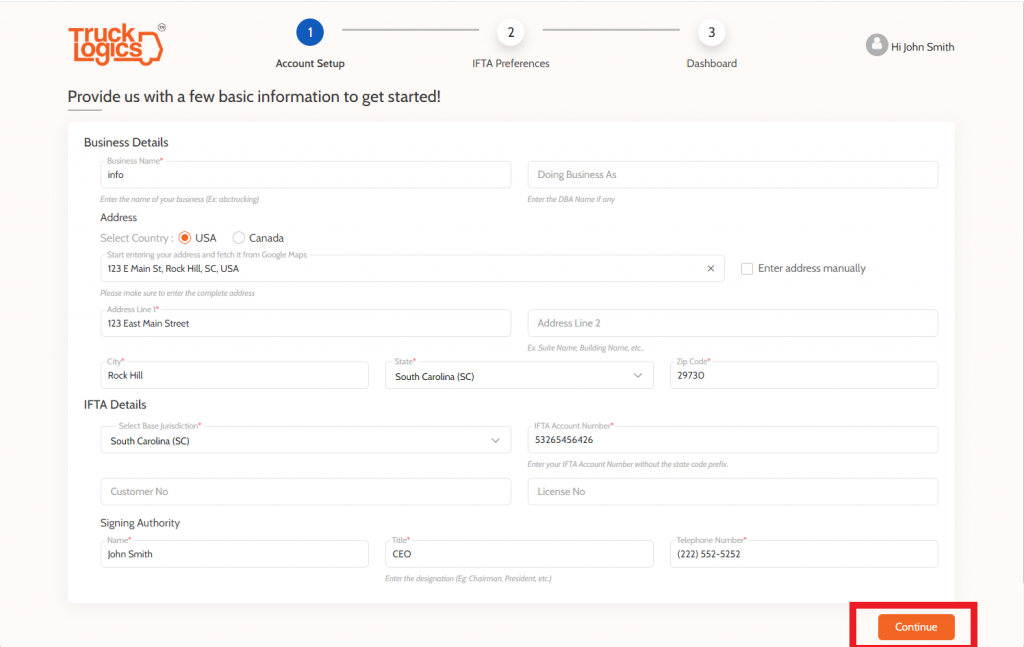

2. Enter your business information including your business name, business address, country, base jurisdiction, and your IFTA account number. Once you do this you will click “Continue”.

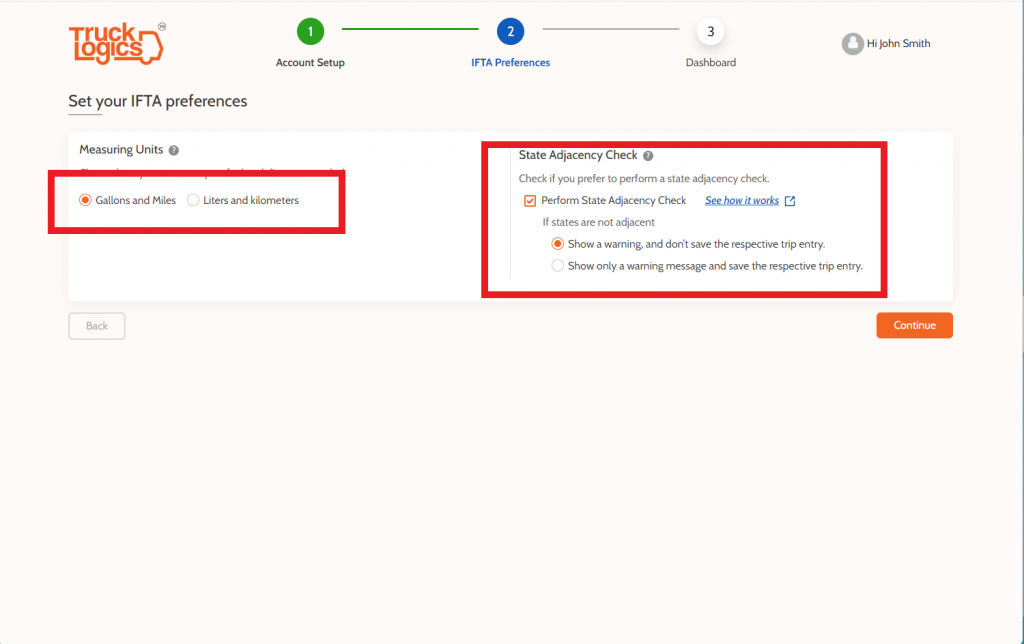

3. Here you can change the fuel usage and distance units from “Gallons” and “Miles” to “liters” and “kilometers” as well as your IFTA Signing Authority.

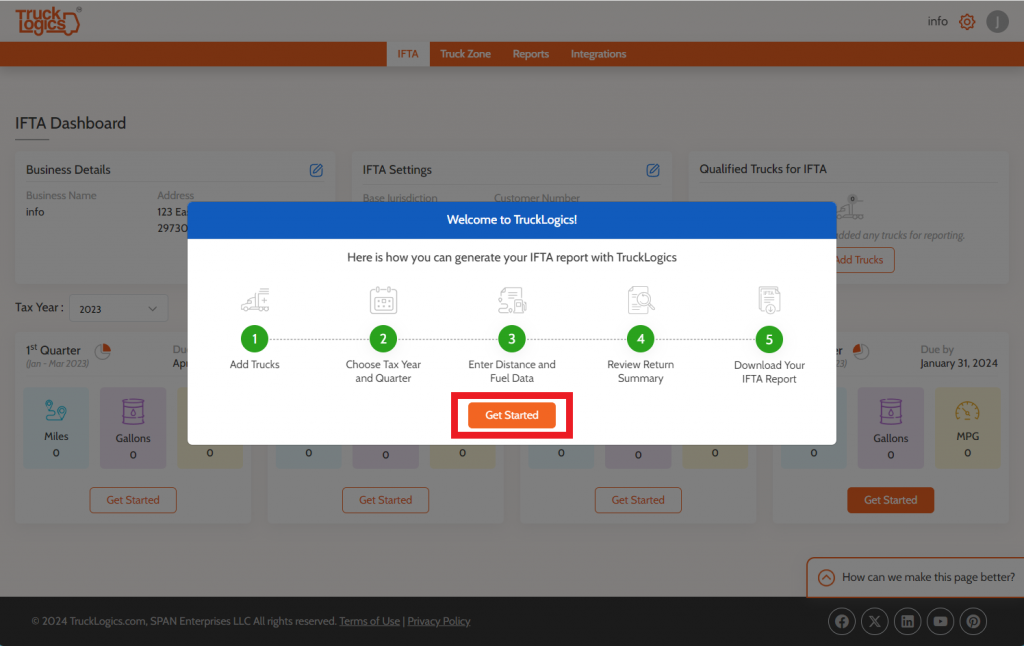

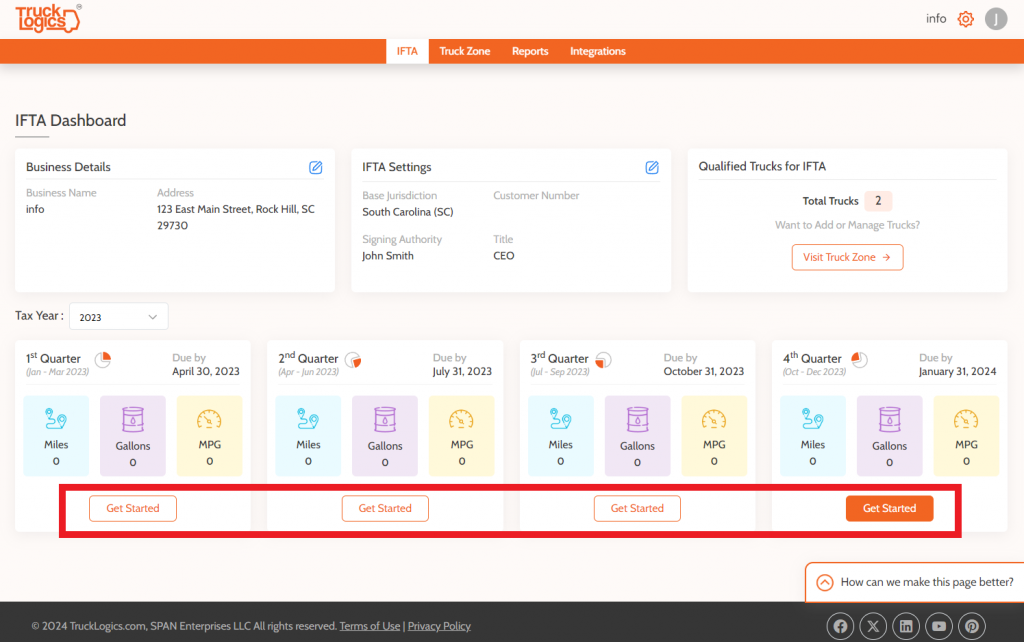

4. Click “Get Started”.

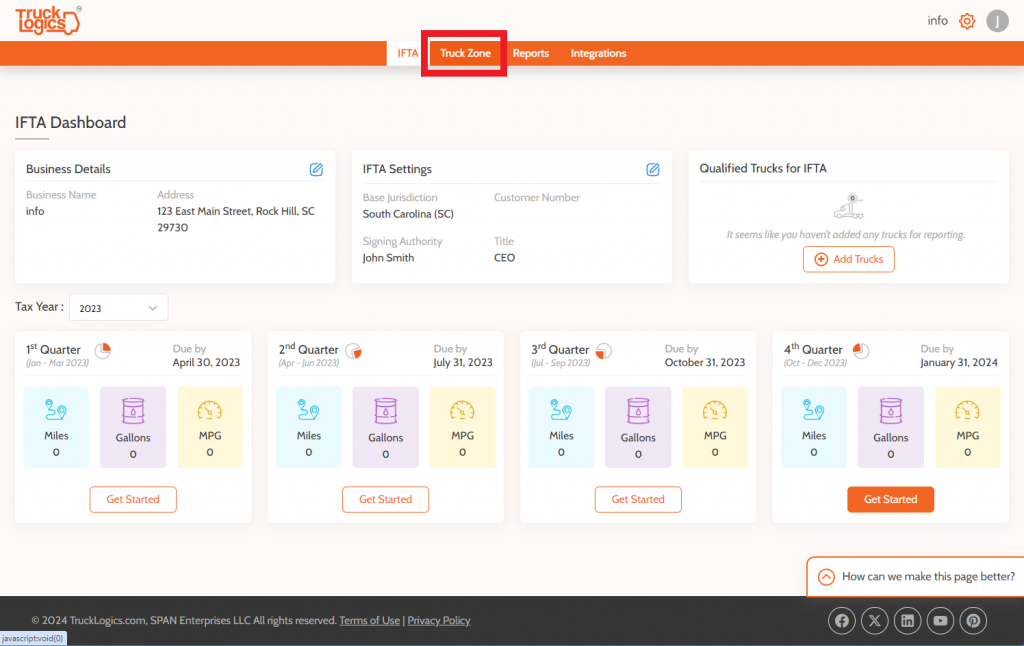

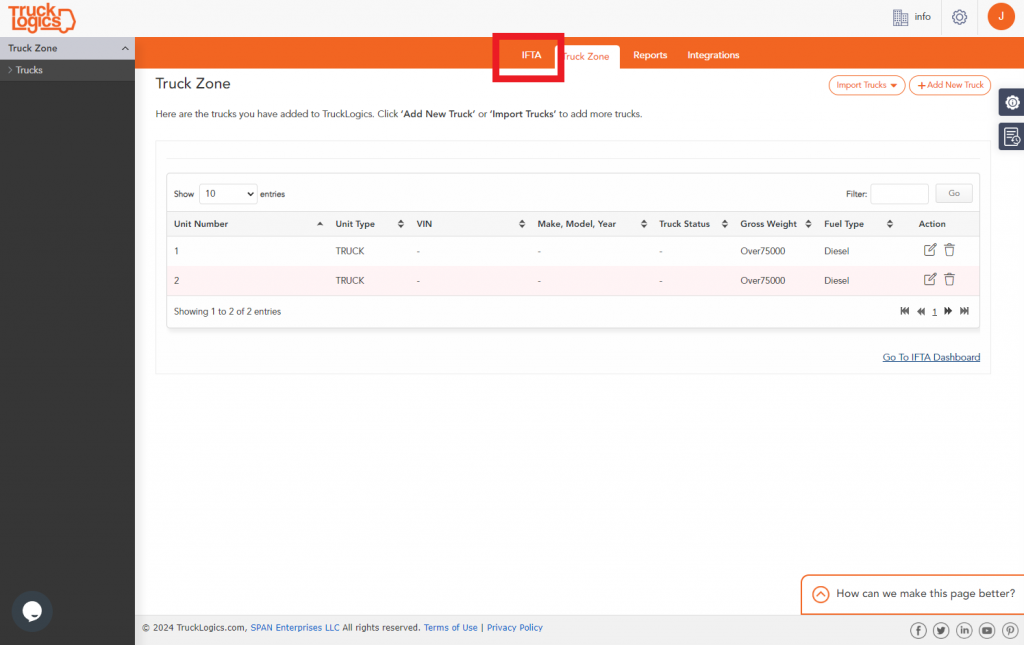

5. Next, you will click the “Truck Zone” tab.

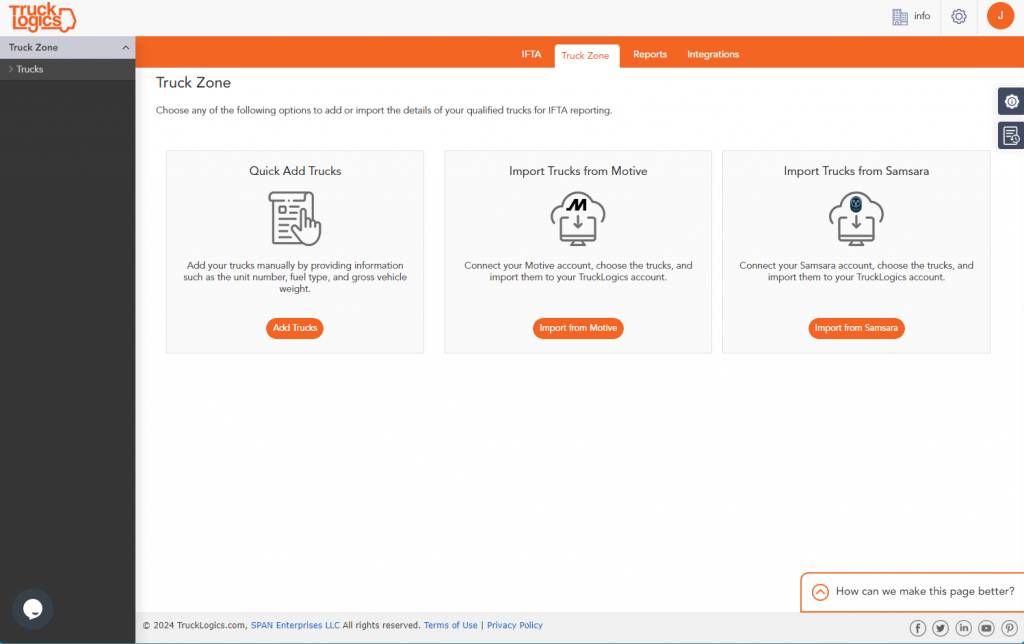

6. Here you can add trucks manually or import them from Motive or Samsara .

For the purposes of this tutorial, we will select the “Add Truck Manually” option.

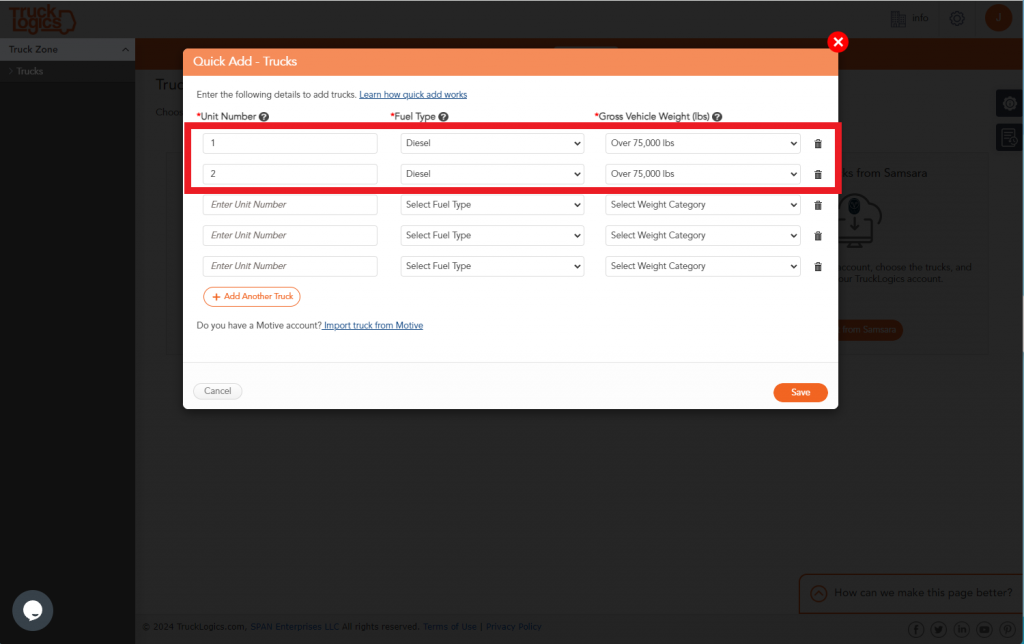

7. When you select this option you will enter the truck’s Unit Number, Make, Model, Fuel Type, VIN, and Gross Vehicle Weight.

8. When you finish adding all of the trucks you are generating the report for, you will click on the “IFTA” tab.

9. Choose “Start Return” under the appropriate quarter.

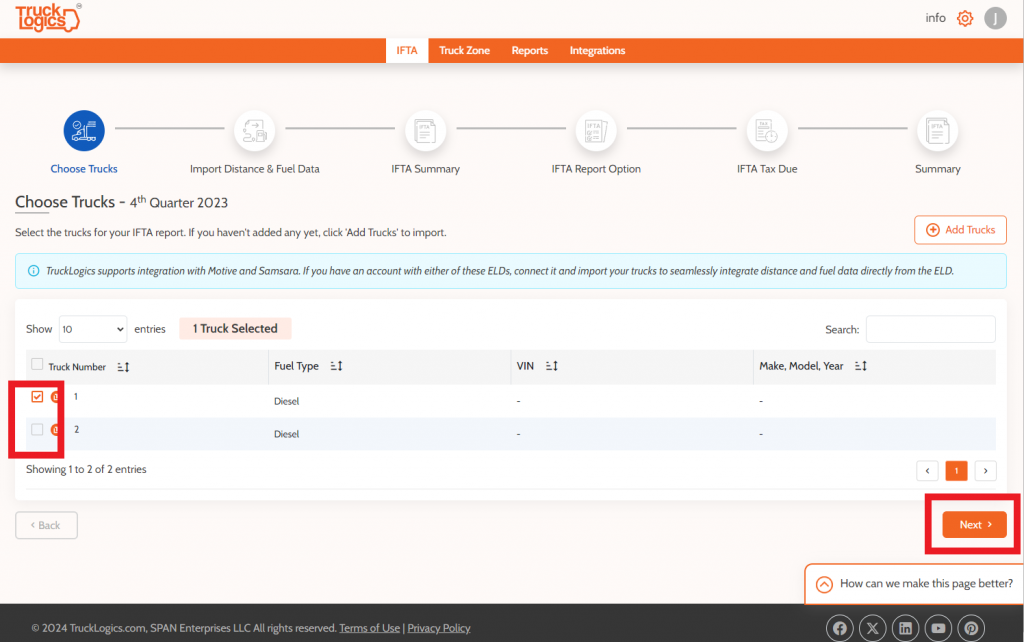

10. Select which trucks you want to generate the report for or add new trucks.

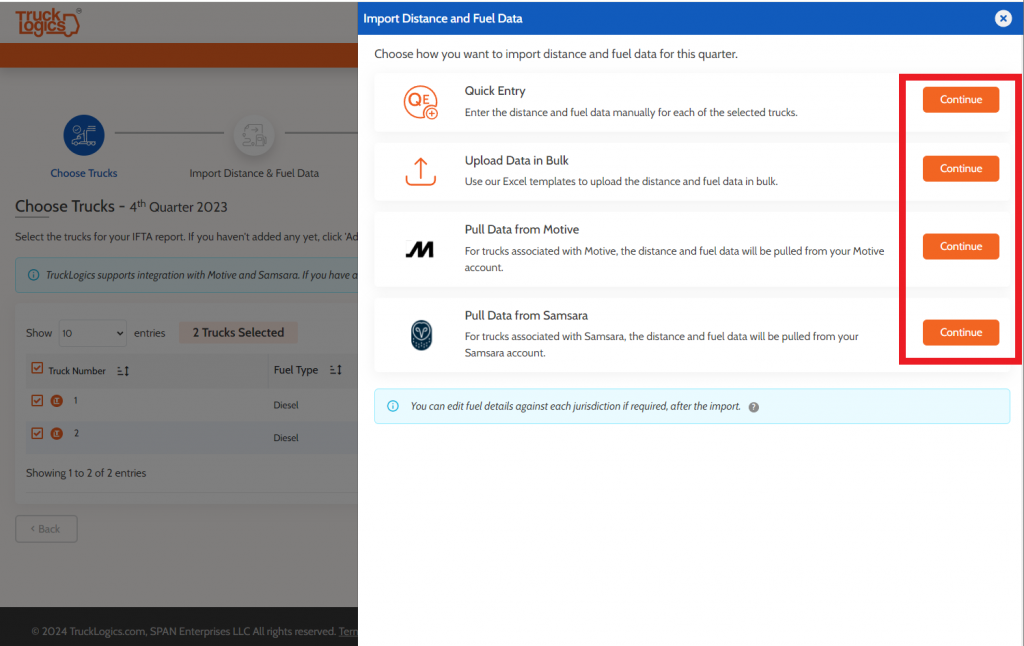

11. You then will be asked how you want to import distance and fuel for this quarter. You can either select “Upload Data in Bulk” where you can use the TruckLogics IFTA Excel template to upload your data at once, “Quick Entry” where you will enter the distance and fuel data manually for each truck, or “Pull data from Motive” where you can import Distance and Fuel data from your connected Motive account.

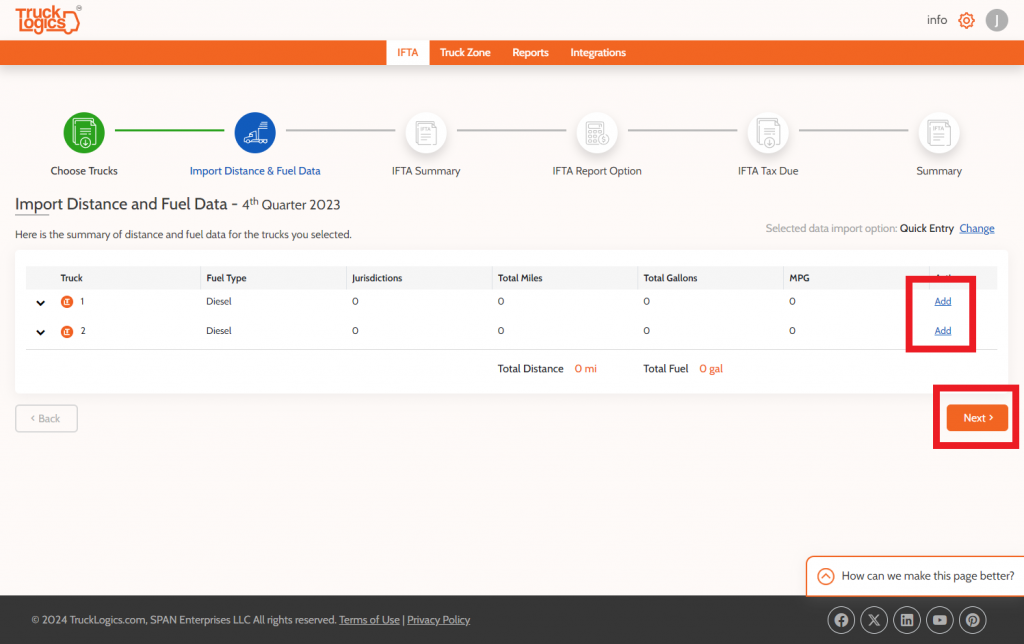

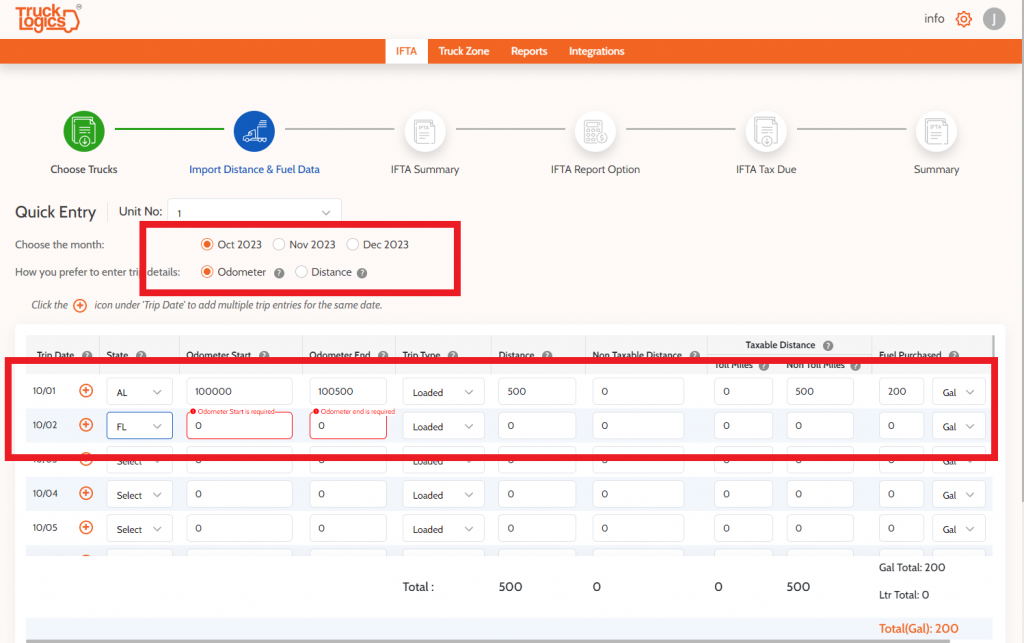

12. If you select “Add” select the QE button beside each truck and enter the data manually either by odometer or distance.

13. Make sure all of the information is entered for each month including trip date, state, odometer start, odometer end, trip type, distance, nontaxable distance, toll miles (if applicable), and fuel purchased. Then you will click “Save”.

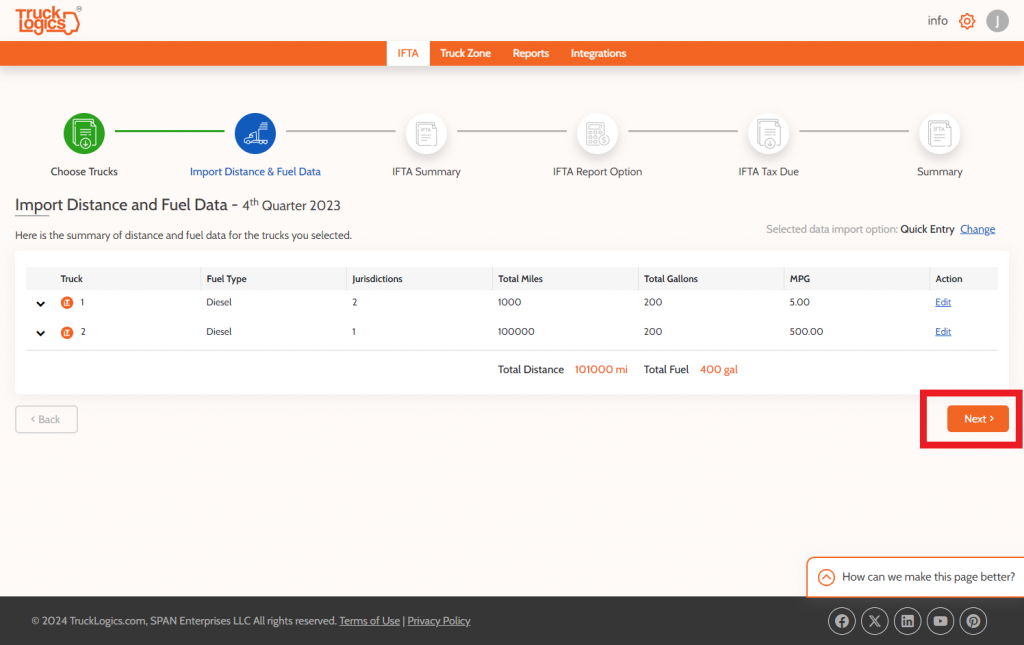

14. Once the data for all trucks has been added click “Next”.

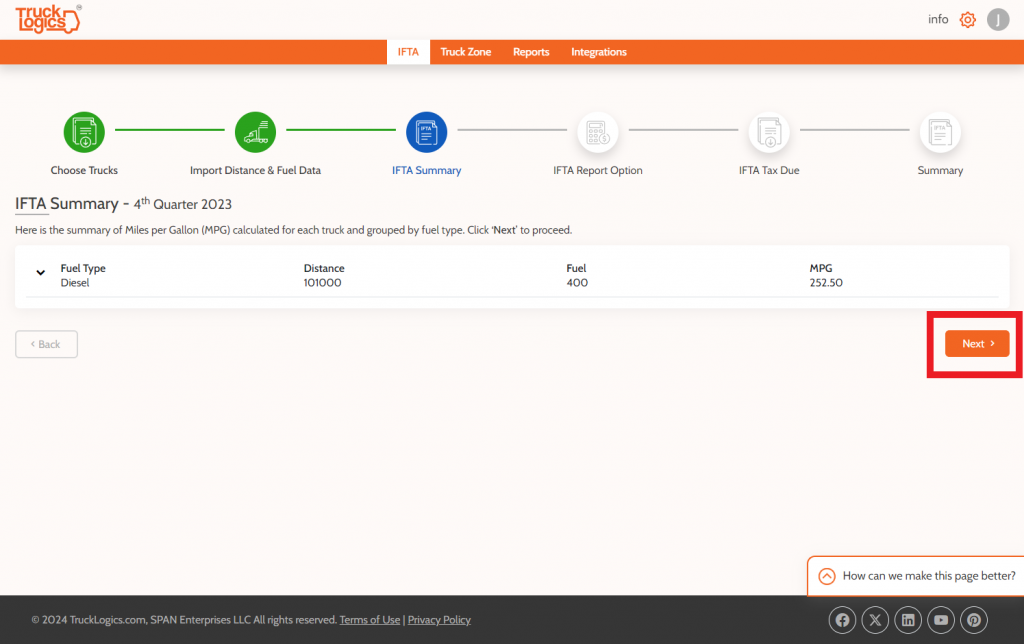

15. Review the IFTA summary and click “Next”.

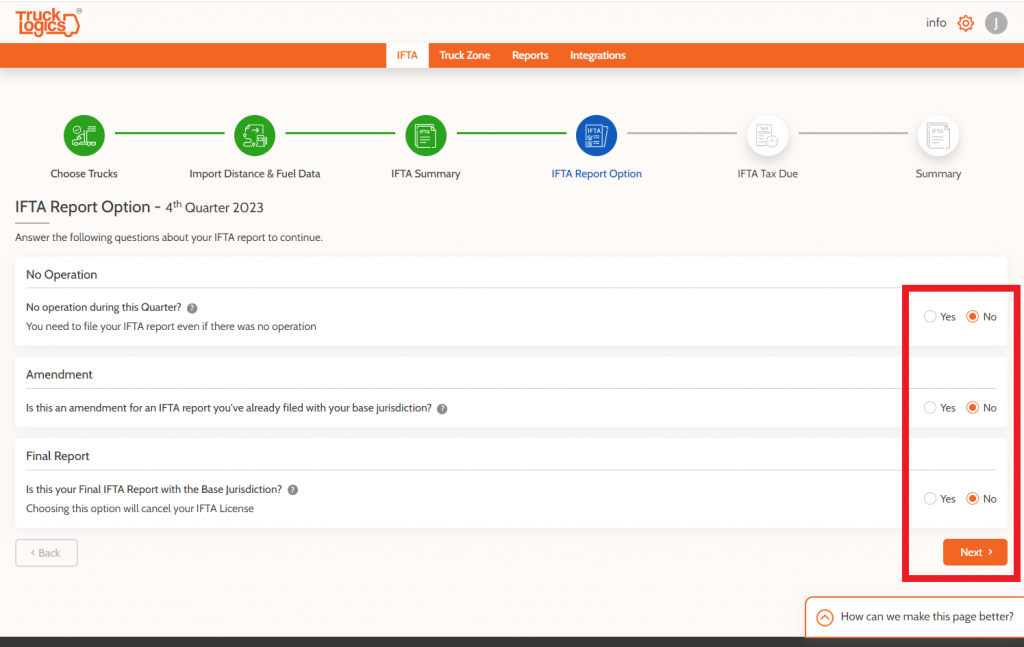

16. Check any boxes for No Operation, Amendment, or Final Report. And click Next.

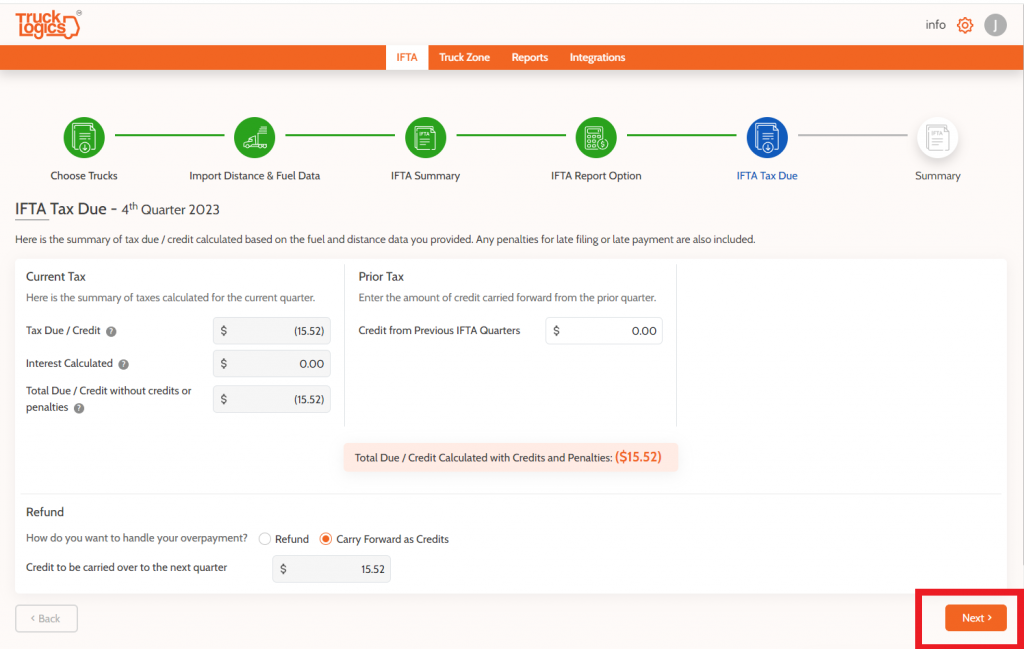

17. You will now see the tax amount you owe. If you have any credits from previous IFTA filings enter them into the box labeled “Credit Amount”.

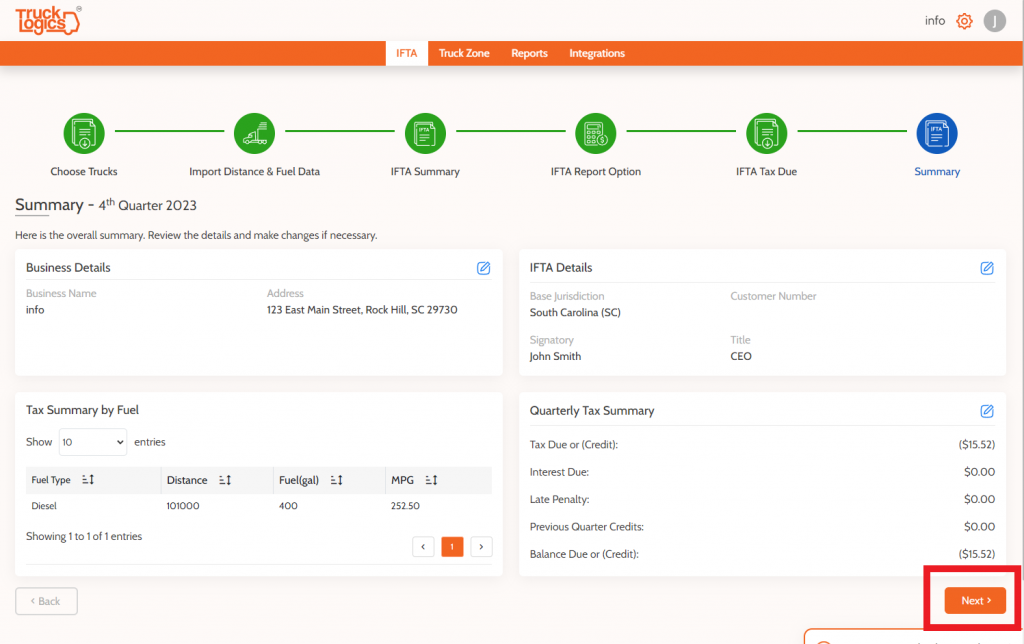

18. Review the information one last time and then click “Next” again.

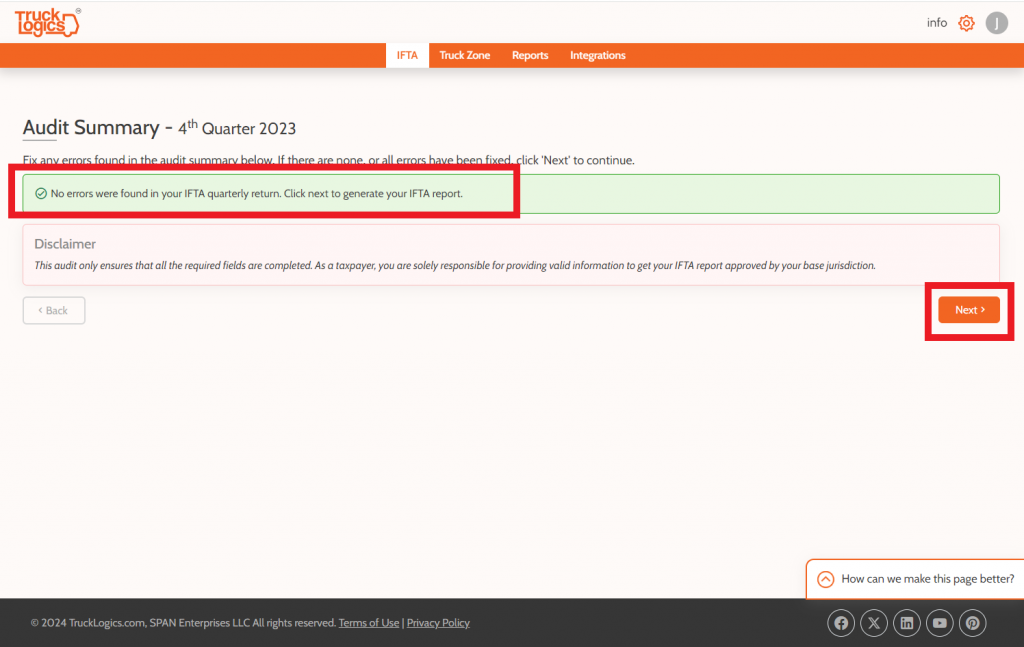

19. The system will check your return and make sure all of the necessary data has been entered and nothing was left blank. If needed, add any of the missing data, and then click “Next”.

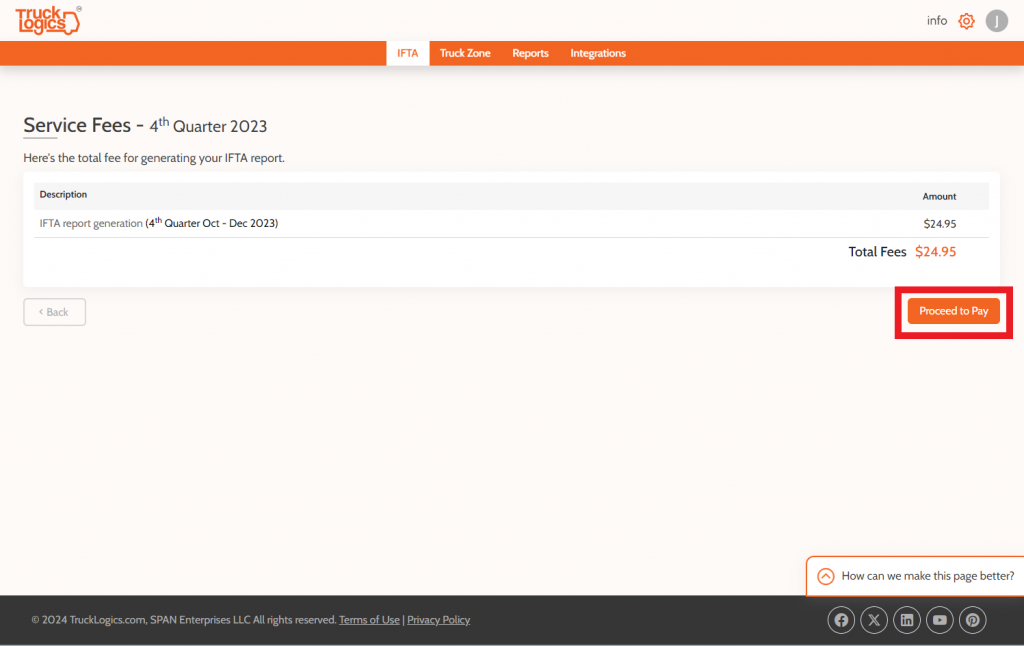

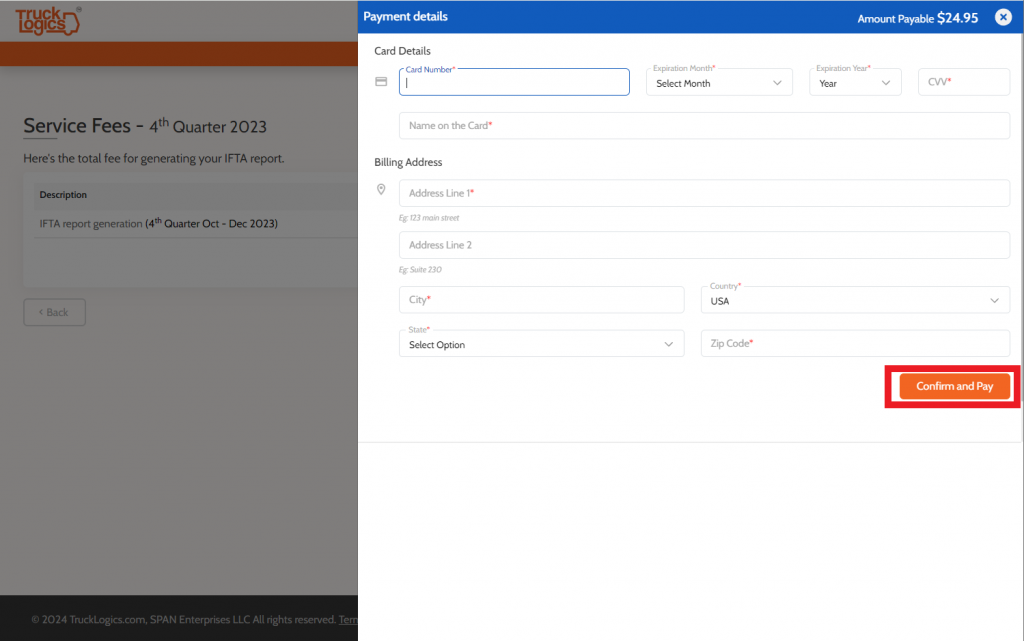

20. Now it is time to pay the service fee. Click “Proceed to Pay”.

21. Enter your billing information and click “Confirm and Pay”.

22. Once you pay the service fee, you can download your IFTA Report by clicking “Download IFTA PDF”. Print it and file it with your base jurisdiction.

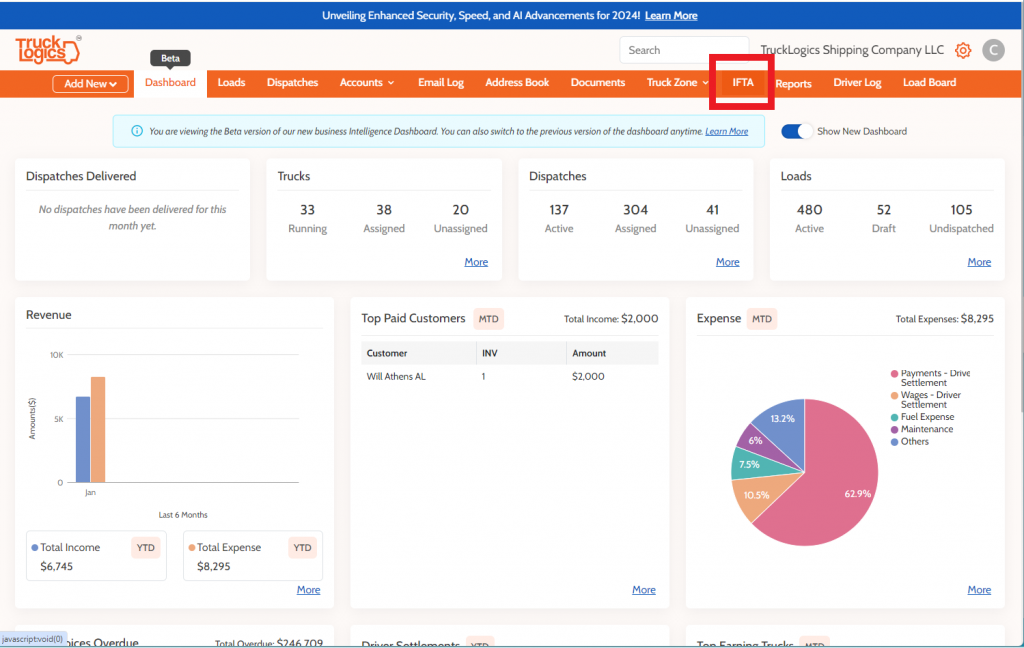

Create an IFTA Report from TruckLogics Account (for Preferred and Premium plans only)

1. From anywhere in your TruckLogics Account select the “IFTA” Tab.

2. From here you will follow steps 4 through 22 from the tutorial above to complete your IFTA report. The only difference is that you will also have the option to upload data from trip sheets and fuel expenses from your TruckLogics account for IFTA reporting. IFTA generation, in this case, is also included in the prices of the subscription instead of having to pay per report.

Not all states allow you to paper file. Instead, they require you to file using their file system. For those states, TruckLogics provides an e-file worksheet to make entry into the state’s e-file system easier. This comes at no extra cost to you, however, it is your responsibility to know whether or not your state allows paper filing or only allows e-filing. A worksheet does not constitute a valid refund request. Regardless, TruckLogics has the solution for all of your IFTA needs whether you use the IFTA-only option or report IFTA directly from your TruckLogics account.

What are you waiting for, go to TruckLogics and start reporting IFTA today!

Leave a Comment